UK inflation drops but food keeps inflation high

Price rises in the UK slowed for a second month in a row but the cost of food including milk, cheese and eggs kept inflation at a 40-year high.

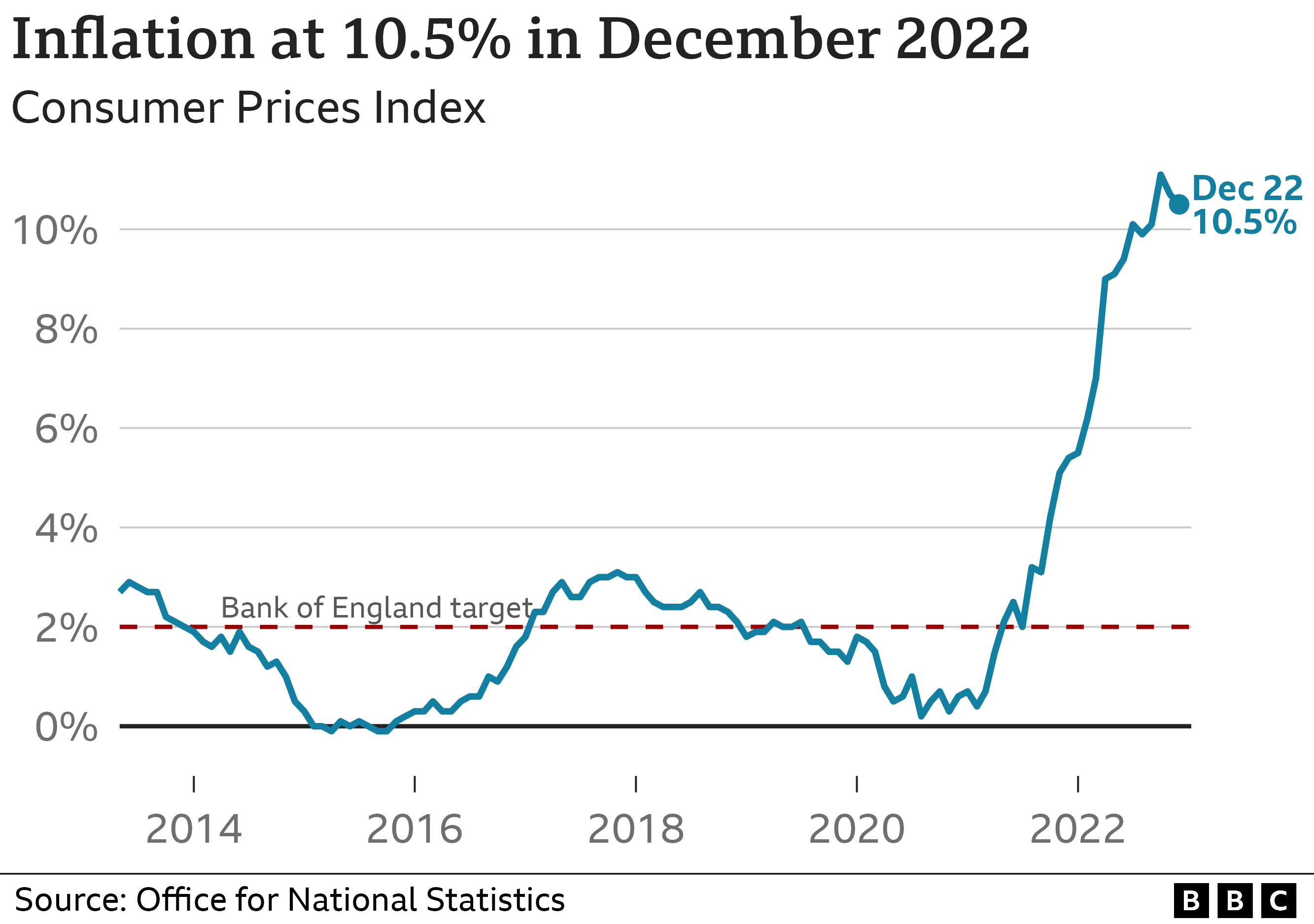

Inflation, which measures the rate of price rises, fell to 10.5% in the year to December from 10.7% in November.

Petrol and diesel costs eased last month but food prices continued to soar, reaching the highest since 1977.

Restaurants and hotel prices also jumped in December along with a record rise in air fares.

Millions of people are struggling with the cost of living which has been rising steadily as Covid restrictions eased and Russia launched its assault on Ukraine.

Food prices rose 16.8% in the year to December as many families splashed out for Christmas, according to the Office for National Statistics (ONS).

Basics such as milk, cheese and eggs saw the largest increases. Prices for sugar, jam, honey and chocolate as well as soft drinks and juices also jumped. However, price growth slowed for bread and cereals.

Inflation is the increase in the price of something over time and to calculate it, the ONS keeps track of the prices of hundreds of everyday items.

If it falls, it does not mean the prices of goods are going down, it just means prices are rising more slowly.

Some analysts believe that the cost of living may now slowly be beginning to ease after hitting what is believed to be the peak, of 11.1%, in October.

But at 10.5%, UK inflation is still way above the 2% target the Bank of England is charged with meeting.

How are you being affected by the rising cost of living? Get in touch.

- Email [email protected]

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Please read our terms & conditions and privacy policy

Grant Fitzner, chief economist at the ONS, told the BBC’s Today programme that a driver behind inflation dipping was because petrol prices had dropped 8p per litre last month, while diesel had fallen by 16p per litre.

Average petrol and diesel prices stood at £1.55 and £1.79 per litre in December 2022.

“It is important to point out although we’ve seen a second consecutive easing, it is fairly modest fall and inflation is still at a very high level with overall prices rising strongly,” he added.

There are some barriers to a sharp fall in inflation.

Mr Fitzner said that private sector pay, which grew 7.2% in the three months to November, was at the “strongest for many decades”. Average pay overall has grown at the fastest rate in more than 20 years, but is still failing to keep up with rising prices.

Coach and air fares also showed grew strongly in December, with the cost of plane travel up 44.1% – the largest recorded rate since January 1989.

Despite inflation dipping for the second month in a row, Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown said there was still a “long way to go before the price spiral is under control”.

“With the jobs market still tight, energy set to stay elevated and relentless food price rises continuing it will mean inflation stays stickier for longer,” she added.

Shannon McIntyre, a florist who runs Feather & Fern in Hawes, North Yorkshire, said that she has had to raise the costs of the flowers she sells. A shortage of roses, for example, had caused prices to double.

She described the increases as “ridiculous”.

“[The price] does go up. It does peak at Valentine’s Day, Mother’s Day, Christmas but it’s the highest we’ve ever seen it,” she said.

Roses will now cost upwards of £6 per stem, compared to a previous price of £3 each.

“We’re trying to work out what else we can do,” said Ms McIntyre.

The Bank of England has been raising interests since December 2021 to quell rising prices – the are currently 3.5%. The Bank will hold its next rate-setting meeting in February.

Increasing interest rates is one way to try and control inflation as it raises borrowing costs and should encourage people to borrow and spend less.

Ms Streeter said the UK should be braced for further interest rate rises from the Bank, adding that a half a percentage point rise “is still firmly on the cards”.

Inflation is forecast to more than halve over the coming year, not because of any government action, but because it compares prices now with a year ago.

The big jump in fuel prices began last February. Once we get to March the difference between current prices and those 12 months before won’t look quite as striking.

So far, the official forecasts from the Office for Budget Responsibility have proved relatively accurate, anticipating inflation would peak at around 11%, which it did last autumn, before falling back.

It has forecast the rate of inflation will fall to less than 7% by this summer and 4% by the end of the year, but what’s hard to imagine now is that it also forecasts inflation will turn negative in the middle of 2024.

While that may mean the cost of living falls a little, it won’t be anything like enough to make up for the drop in living standards this inflation is expected to cause – the worst in over four decades.

Chancellor Jeremy Hunt said while any fall in inflation was “welcome”, it was “vital” that the government took “difficult decisions” to try to bring it down further.

But Shadow Chancellor Rachel Reeves said: “Each passing day brings more and more evidence that people are feeling worse off under the Tories.”

Prime Minister Rishi Sunak has pledged to halve inflation this year, but many forecasters have predicted this will happen as the cost of energy falls.

“High inflation is a nightmare for family budgets, destroys business investment and leads to strike action, so however tough, we need to stick to our plan to bring it down,” Mr Hunt said.